CUSTOMS CLEARANCE

TURNKEY

IN BISHKEK IN 1 DAY

WE'LL SPEED UP RECEIPT

Of your goods from the terminal

WE'LL PREVENT ERRORS

When filling out required documentation

WE'LL REDUCE EXPENSES

Up to 20% on downtimes and penalties

WE'LL MINIMIZE LOSS RISKS

Financial, time, and stress

WHAT YOU NEED TO KNOW

About customs clearance of goods

TNVED Codes

All goods imported or exported through the customs border have their own TNVED codes, according to the Commodity Nomenclature of Foreign Economic Activity. Based on the ten-digit TNVED code for a product, the rate of import customs duty is determined, as well as what permits and certificates are needed. Throughout the world, the codes are almost identical at the level of the first 6 digits. You can view the list of TNVED codes and rates of import customs duties of the EAEU here.

Customs Payments

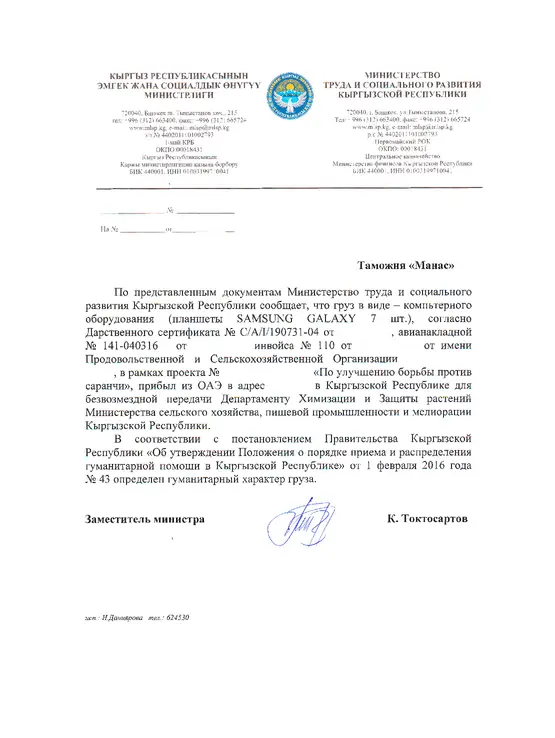

The basis for calculating customs payments is the customs value - this is the invoice value of the goods + expenses for delivery, packaging and insurance. There are 4 main types of customs payments: 1) VAT 12%; 2) customs duty (rate according to TNVED code); 3) customs fee 0.25%; 4) excise tax on excisable goods (alcohol, tobacco, petroleum products). Some categories of goods may be exempt from customs payments, such as: humanitarian aid, medicines, cargo addressed to international organizations, etc.

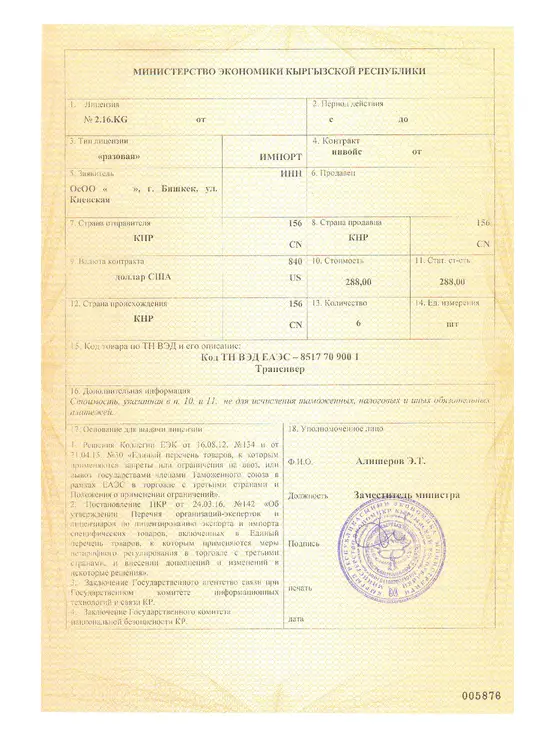

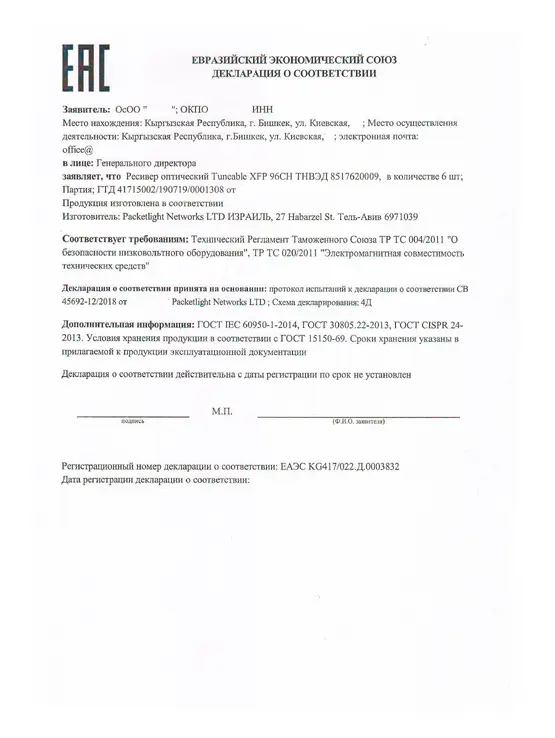

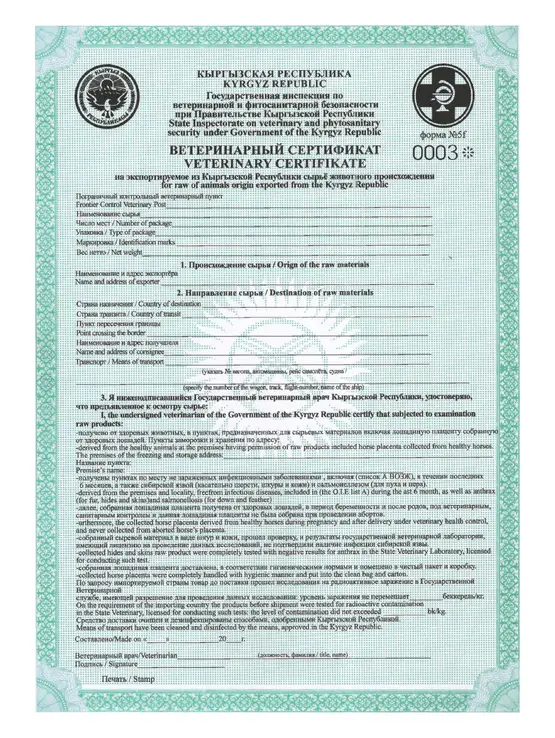

Permitting Documents

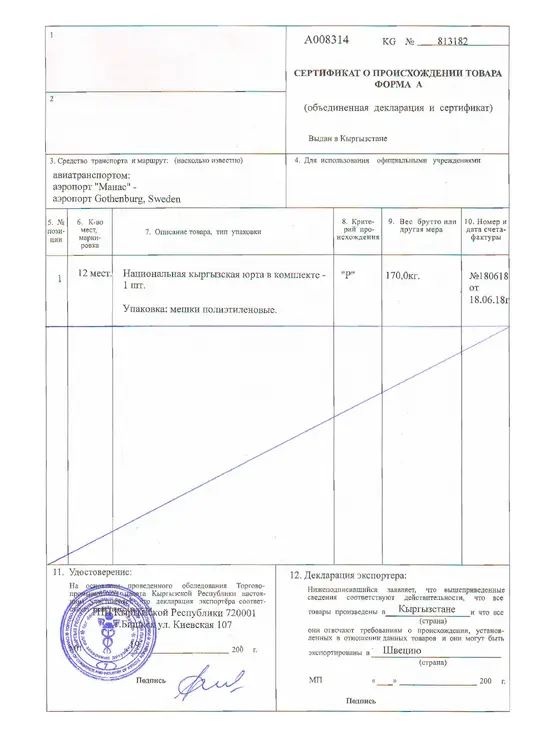

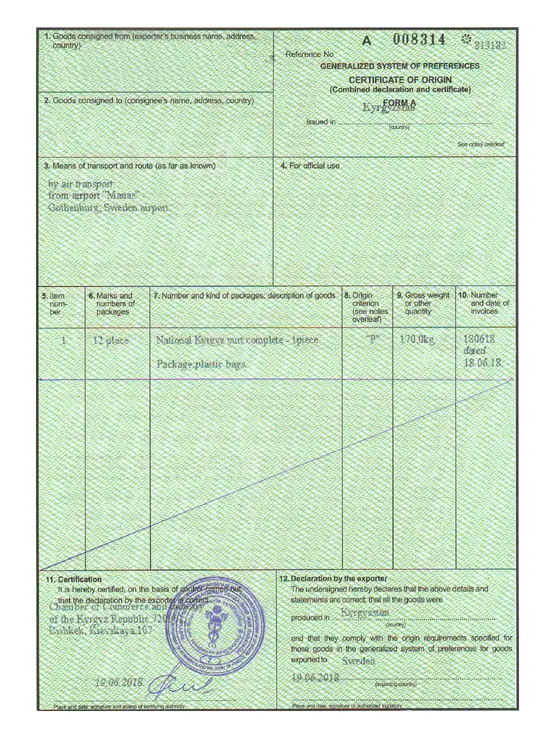

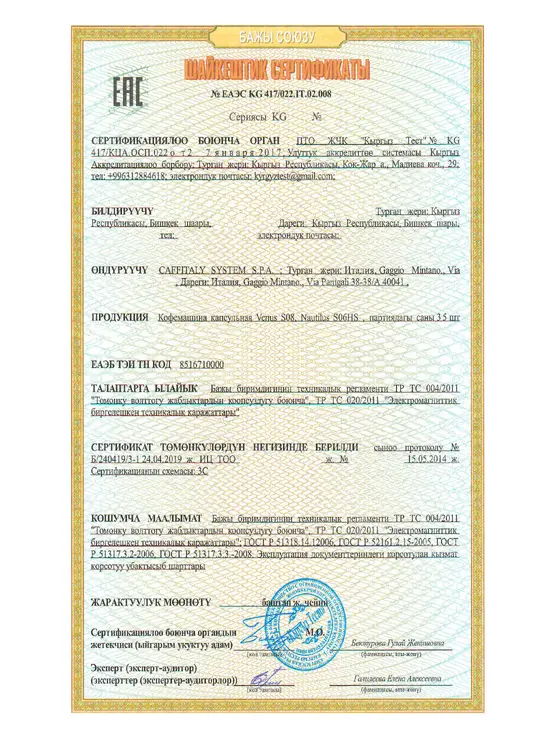

According to TNVED codes (i.e. depending on the product), it is determined which permitting documents need to be provided for a particular product, and for which these permits are not needed. This is called non-tariff trade regulation measures. There are many EAEU Technical Regulations and internal legislative acts that regulate the procedure for obtaining permitting documents. Documents required by customs for export and import include: Declaration and certificate of conformity, certificate of origin, phytosanitary and veterinary certificates, expert opinions, licenses and letters.

Customs Clearance Procedure

The process of customs clearance of goods consists of several consecutive stages:

- Analysis and preparation of documents for cargo

- Electronic declaration of goods in the UAIS system

- Submission of documents to customs authorities (in electronic and paper form)

- Payment of customs duties

- Verification of all documents and customs inspection

- Release of cargo and receipt of customs declaration

- Payment for terminal services and delivery of cargo to the recipient's warehouse

List of Transaction Documents

Any movement of goods across the customs border is subject to customs control and clearance! There is a simplified procedure for customs clearance (for personal items and diplomatic mail) and a standard method - by declaring goods, providing all documents and paying customs duties. The list of standard documents when shipping cargo includes:

- Invoice (issued by the sender-seller and contains complete information on the product, quantity and price - similar to an invoice)

- Packing list (also compiled by the sender-seller and informs about the quantity and dimensions of places, packaging, weight of the cargo and its volume)

- Transport waybill (issued by the transport company, depending on the type of transport: auto - CMR, air - AWB, railway - RWB)

- Certificates (depending on the nature of the goods)

- Contract (drawn up by the parties to the transaction and contains all agreements between the seller and the buyer)

Cargoes from EAEU Countries

Any cargoes from EAEU member countries: Kazakhstan or Armenia - are not subject to customs clearance and customs control. All other countries are considered third countries and all cargoes from them are subject to customs clearance. You can view the procedure for importing goods from EAEU countries here.

FORMULA FOR CALCULATING CUSTOMS PAYMENTS

How to calculate customs payments?

Customs Value

Customs value is the value of goods determined for the purpose of charging customs payments (duties, customs fees, excise taxes, and VAT). Customs value includes all delivery expenses: invoice (net) value of goods + packaging costs + insurance costs + transportation costs.

Example: $1000 (invoice value of goods) + $200 (transportation costs) + $50 (insurance) = $1250 - customs value

Customs Duty

The customs duty rate is determined according to the Unified Customs Tariff (UCT) of the EAEU based on the TNVED code of the goods. Find your product and the import customs duty rate here.

Formula: Customs value × duty rate = duty amount

Example: 1250 × 10% = 125

Excise Tax

Rates for excisable goods can be found here. Excise tax is calculated based on the quantity of goods based on the unit of measurement (liter, piece, kilogram, milliliter, ton).

Formula: Quantity of goods × excise rate = excise amount

Example: Cigars 1000 pieces × 175 som/1 piece = 175000 som - excise tax

VAT

The Value Added Tax (VAT) rate in the Kyrgyz Republic is 12%. When there is a customs duty on the goods, VAT is calculated using the following formula:

(Customs value + duty amount + excise amount (if any)) × 12% VAT = VAT amount

Example: (1250 + 125) × 12% = 165 - VAT amount (without excise)

Example: (1250 + 125 + 100 (excise)) × 12% = 177 - VAT amount (with excise)

If the duty rate on the goods is 0%, VAT is charged on the Customs value. Example: 1250 × 12% = 150 - VAT amount

Customs Fee

The customs fee rate is 0.4%

Formula: Customs value × 0.4% = customs fee amount

Example: 1250 × 0.4% = 5.00 - customs fee amount

CUSTOMS DEPARTMENT GUARANTEES:

TRANSACTION SECURITY

Our activities are insured for 500,000 Euros

PROTECTION FROM OVERPAYMENTS

Only verified expenses

DELIVERY TIME GUARANTEE

Personally interested in fast processing

ANY CUSTOMS REGIMES

Experience and understanding of customs clearance procedures

OPERATING TRANSPARENTLY

Complete financial reporting

CONFIDENTIALITY

Full protection of information about your shipments

ANSWER 4 QUESTIONS

And we will provide the costs for customs clearance of your cargo

STEP 1 / 5

What type of customs clearance do you need?

COMPREHENSIVE SERVICES

Customs Representative

Northern Eagle LLC provides services as a customs representative (broker)

Years of experience, certified specialists, and the necessary technical base allow us to provide high-quality customs clearance services in the shortest possible time at all regional customs offices in Bishkek and Chuy region.

All customs brokers of the company have Qualification Certificates of specialists in customs operations, issued by the State Customs Service of the Kyrgyz Republic.

Our service package includes:

Preparation and analysis of customs documentation (invoices, packing lists, contracts, certificates)

Preparation and collection of necessary permits for export and import

Calculation of customs payments and other expenses

Selection of TNVED codes

Customs declaration (filling out forms: customs declaration (TD1, TD2), preliminary information (PI), customs value declaration (DTS), TTN/CMR, TIR)

Customs declaration adjustment (KDT)

Customs clearance of goods - any customs procedures

Customs logistics - organization of all interaction processes with terminals and other related services

Representation of foreign trade participants' interests in customs authorities

Payment of customs duties

Delivery and unloading of cargo from temporary storage warehouses and customs warehouses - "door-to-door" to the recipient - with our own resources

Consultations in the field of customs and foreign economic activity

DOCUMENTS WE WILL

OBTAIN FOR YOU

AND SAVE YOUR TIME